All Categories

Featured

Table of Contents

- – How Much Does Foreclosure Overages Training Cost?

- – What Are The Key Benefits Of Enrolling In An O...

- – What Are The Best Online Courses For Revenue ...

- – What Is The Most Comprehensive Course For Und...

- – What Is The Most Popular Course For Real Est...

- – How Does Bob Diamond Define Success In Inves...

Doing so does not cost hundreds of thousands of bucks like acquiring multiple tax obligation liens would certainly. Instead, your research study, which might include skip tracing, would certainly set you back a somewhat little fee. Any kind of state with an overbid or exceptional proposal method for public auctions will certainly have tax sale overage chances for capitalists. Keep in mind, some state statutes avoid overage choices for past proprietors, and this issue is actually the topic of a current High court instance.

Your sources and method will certainly identify the most effective atmosphere for tax obligation overage investing. That stated, one strategy to take is accumulating passion on high costs. Therefore, investors can get tax obligation sale overages in Florida, Georgia, and Texas to make use of the premium quote legislations in those states.

How Much Does Foreclosure Overages Training Cost?

Any kind of public auction or repossession including excess funds is an investment possibility. You can spend hours researching the past proprietor of a residential or commercial property with excess funds and call them only to find that they aren't interested in seeking the money.

You can start a tax overage service with very little expenses by finding information on current properties cost a costs quote. Then, you can speak to the previous proprietor of the property and offer a cost for your solutions to aid them recover the overage. In this scenario, the only cost involved is the research as opposed to costs tens or numerous thousands of dollars on tax liens and deeds.

These excess usually generate rate of interest and are offered for past proprietors to case. For that reason, whether you purchase tax obligation liens or are entirely interested in insurance claims, tax obligation sale excess are financial investment possibilities that require hustle and solid research study to make a profit.

What Are The Key Benefits Of Enrolling In An Overages Workshop Course?

Pro Participants Get Full Gain access to Succeed in genuine estate attaching tried and tested toolkits that have actually helped countless striving and existing financiers achieve monetary freedom. $0 TODAY $32.50/ month, billed each year after your 7-day trial. Terminate anytime.

These buildings are provided for sale "AS IS", at the danger of the purchasers and neither the Area neither any kind of various other party makes service warranties or depictions whatsoever either revealed or indicated, of any kind of kind, with respect to the homes or the title thereto. In case a tax obligation sale certification is provided and then voided by the Supervisor of Financing via no fault of the customer only a reimbursement of amounts in fact paid on the day of sale shall be made and will be the Director of Money's single responsibility and restriction thereon.

The sale, the premises, and the residential properties are, to the extent offered by legislation, subject to any kind of and all title problems, claims, liens, encumbrances, covenants, problems, restrictions, easements, right-of-way and issues of records. In the occasion of a mistake, defective title, summary or non-existence of building, no reimbursement shall be offered.

What Are The Best Online Courses For Revenue Recovery?

Tax obligation sale excess happen when a tax-foreclosed home is sold at public auction for a greater rate than the owed tax obligations., also called overages, are the difference in between the sale cost and the taxes due.

Excess proceeds healing is a legal procedure that enables property owners to recuperate any type of excess funds (additionally called Excess) left over after a building has been sold at a tax sale. In Texas, the process of excess earnings healing can be intricate, and it's necessary to have a knowledgeable attorney in your corner to ensure that you get the sum total of funds owed to you.

In this article, we'll provide an introduction of excess proceeds healing and the steps you require to take to assert your funds (training resources). Excess earnings are the funds left over after a property has been offered at a tax sale for even more than the quantity of delinquent tax obligations, fines, rate of interest, and costs owed on the property

What Is The Most Comprehensive Course For Understanding Claims?

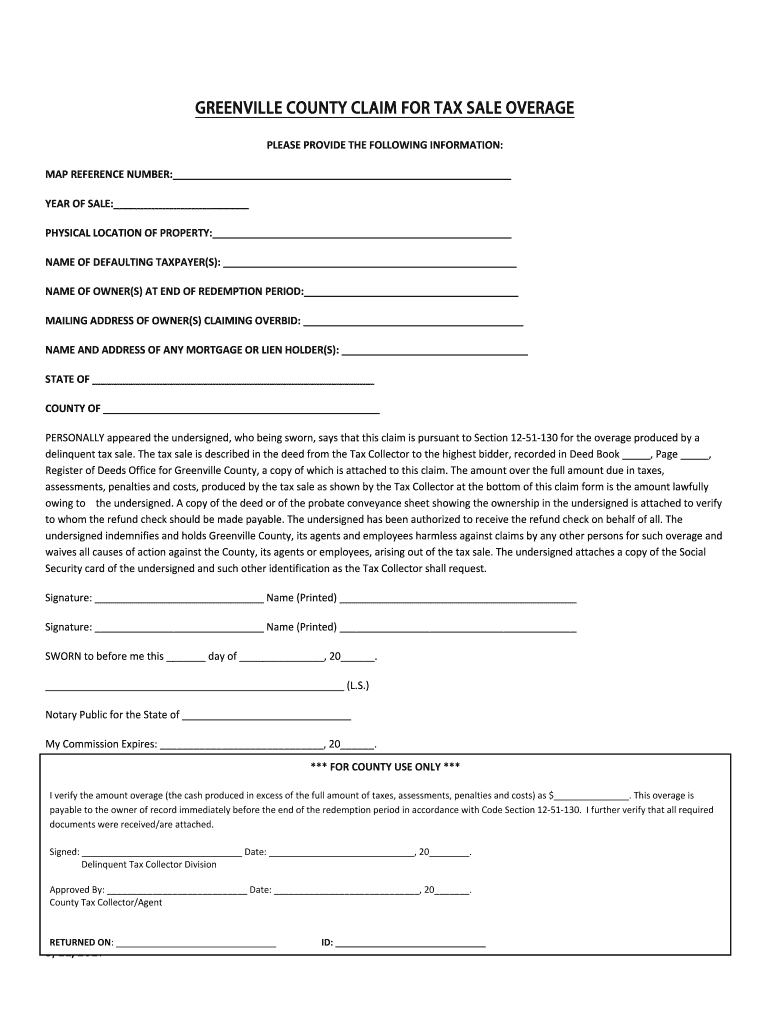

These include:: You have to file a case for the excess profits with the county district court in the region where the home was marketed. The insurance claim has to be submitted within the specified time period, usually 2 years from the day of the sale. Building videotaped for a firm have to be stood for in court by an attorney in Texas.

Each area court typically has particular paperwork and sustaining proof needed for recuperation of excess proceeds.: You may be called for to pay court or filing costs to file your claim, in addition to any kind of added management & handling charges called for to acquire your excess proceeds.: If there are several cases on the excess proceeds, a hearing may be called for to figure out the rightful proprietor.

At the we can help you with every action of the excess earnings recovery procedure. training courses. Our seasoned attorneys can help you submit a claim, provide the needed documents and research, defend you and your claim versus contending complaintants and represent you at any type of called for hearings. If you are a home proprietor or lienholder in Texas, you might be qualified to excess earnings from a tax sale

What Is The Most Popular Course For Real Estate Investing Investing?

Any monies remaining after the fulfillment of the tax obligation sale are taken into consideration to be Excess Proceeds. Events of Passion might claim the Excess Profits within a specified amount of time (Revenue and Tax Code (RTC) 4671 et seq.). Events of Rate of interest are the residential or commercial property's Owners and/or Lienholders, especially specified for Excess Earnings as "anyone with title of record to all or any type of part of the home before the recordation of the tax deed to the buyer" and "lienholders of document before the recordation of the tax action to the buyer." The order of concern on Cases from the events of rate of interest is specified in RTC 4675.

Claims are submitted with the Auditor-Controller, Residential Property Tax Obligation Department. It is advised that some type of postal solution monitoring be utilized when mailing a Case, specifically if close to the due date.

How Does Bob Diamond Define Success In Investment Blueprint?

Layout Insurance claims are offered in the types section on this web page (pick one layout Case per Plaintiff). Each layout Insurance claim consists of guidelines. For concern or support, please contact the Auditor-Controller by phone ( 530) 621-5470, ext. 4 or email AuditorPropertyTaxDivision@edcgov.us!.?.!. Note that State law does not require a particular layout to a Claim. If the Claimant picks to utilize a freeform Case style, please make sure that all required information is provided. Complying with the expiry of the claiming period, the Auditor-Controller will certainly present valid Insurance claims in a Board of Supervisor's (BOS)public hearing. Cases will not be heard by the BOS up until after the asserting duration has run out.

Table of Contents

- – How Much Does Foreclosure Overages Training Cost?

- – What Are The Key Benefits Of Enrolling In An O...

- – What Are The Best Online Courses For Revenue ...

- – What Is The Most Comprehensive Course For Und...

- – What Is The Most Popular Course For Real Est...

- – How Does Bob Diamond Define Success In Inves...

Latest Posts

Tax Sale Homes List

Land Tax Sales

Tax Lien Investing Canada

More

Latest Posts

Tax Sale Homes List

Land Tax Sales

Tax Lien Investing Canada